- Intel faces market challenges and shares dipped by 2.5%, reflecting investor concerns.

- CEO Lip-Bu Tan highlighted Intel’s need for innovation and strategic reinvention.

- The company’s revival strategy focuses on recruiting top engineers and enhancing chip production.

- Intel aims to compete with Nvidia in the growing AI server market.

- U.S. Commerce Secretary suggests financial support contingent on Intel’s domestic investments.

- Global semiconductor demand remains high, affecting competition and innovation speed.

- Investors are advised to consider diversifying into agile AI enterprises for potential returns.

- Intel, a key figure in American tech, faces a challenging but potentially positive future.

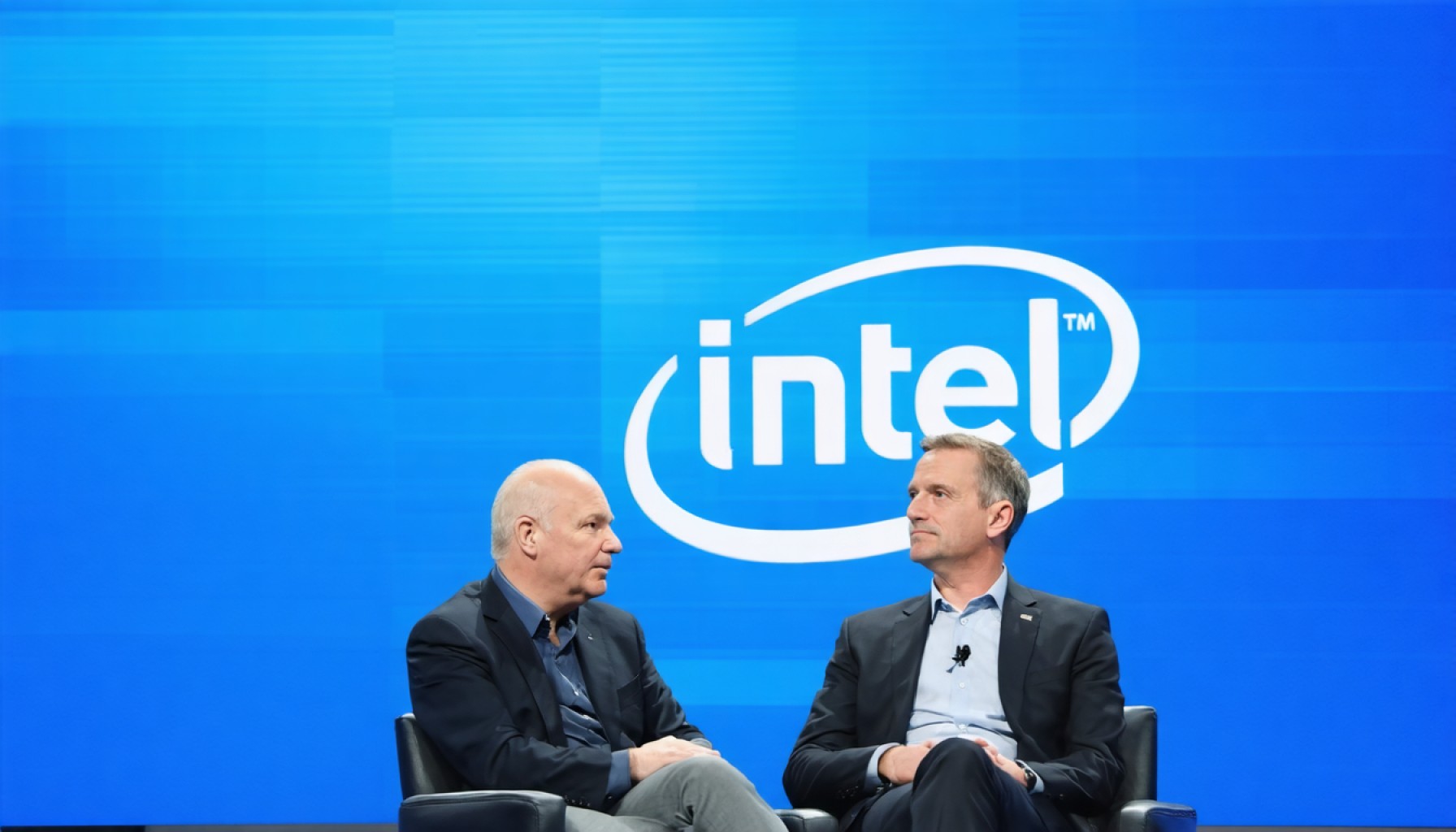

Clouds gather over Silicon Valley as Intel, the titan of microprocessors, grapples with a choppy market and unsettling projections. Investors nervously watched this tech giant’s shares dip by 2.5% after its newly minted CEO, Lip-Bu Tan, offered a sobering diagnosis of Intel’s present challenges. His candid revelations painted a picture of a company lagging in the innovation race and wrestling to regain its former prominence.

Tan’s assessment struck a chord among stakeholders: Intel won’t see an overnight metamorphosis. Instead, they must brace for a protracted journey punctuated by determination and strategic reinvention. The heart of this revival effort hinges on recruiting top-caliber engineers and ramping up Intel’s chip production capabilities. Yet, the company’s grand aspirations extend further: it is poised to clash with Nvidia in the burgeoning realm of rack-scale AI servers, a battleground for cutting-edge technology and lucrative contracts.

Compounding Intel’s hurdles is a broader regulatory storm brewing out of Washington. The assertive tone struck by Commerce Secretary Howard Lutnick adds pressure to an already beleaguered sector. Lutnick’s suggestions to withhold further financial support until chipmakers like Intel commit substantial investments stateside pose an additional layer of complexity. This move reflects a stringent policy embraced by the current administration to bolster American manufacturing.

These developments occur against a backdrop of mounting global demand for semiconductors, underpinning everything from smartphones to sophisticated AI applications. Even as Intel contemplates its path forward, the market’s insatiable appetite for faster, smarter chips reshapes the competitive landscape at a frenetic pace.

For investors, the takeaway is clear yet challenging: opportunities are abundant within the AI sphere, where nimble players might capture near-term gains more swiftly than an incumbent behemoth like Intel. This nuanced scenario heralds a diversification strategy into AI enterprises that could deliver lucrative returns.

The shifting sands of innovation and geopolitics demand resilience and adaptability. For Intel, the vista is daunting but not devoid of optimism. A quintessential symbol of American technological prowess, Intel has navigated turbulent waters before. With strategic recalibration and robust leadership, it could forge a brighter, though arduous, future.

Intel’s Transformation: Navigating Challenges and Opportunities in a Competitive Tech Landscape

Understanding Intel’s Current Position

Intel, once a dominant force in microprocessors, is actively facing numerous challenges. The company’s shares recently dropped by 2.5% after its CEO Lip-Bu Tan highlighted ongoing hurdles. This dip signifies broader concerns about Intel’s ability to innovate and reclaim its market position amid fierce competition.

Key Challenges and Strategic Goals

1. Innovation Lag:

Intel is perceived as trailing behind competitors like AMD and Nvidia in terms of technological advancements, particularly in cutting-edge semiconductor technology and AI applications.

2. Recruitment Drive:

To combat this, Intel is focusing on attracting skilled engineers to bolster its R&D efforts and accelerate innovation in chip production.

3. Regulatory Pressure:

Commerce Secretary Howard Lutnick’s emphasis on domestic investment underscores the U.S. government’s new policy stance, which could influence Intel’s strategic decisions regarding manufacturing investments.

4. AI Server Competition:

The emergence of AI servers as a crucial technology front pits Intel directly against Nvidia, a leader known for its dominance in AI-compatible hardware solutions.

Industry Trends and Analysis

Global Demand for Semiconductors:

The semiconductor industry continues to experience robust growth due to the expanding demand for AI, IoT devices, and electrification in various sectors.

AI Investments:

AI technology is rapidly evolving and presents significant opportunities for growth. Companies that invest in AI may see lucrative returns, as seen with Nvidia’s success in this field.

Market Forecasts and Opportunities

According to market analysts, the semiconductor industry is expected to grow by 8% annually, driven largely by AI and IoT applications. Intel’s focus on rack-scale AI servers is a strategic move to capture a share of this growing market.

How Intel Could Succeed

1. Strategic Partnerships:

Collaborating with leading tech firms and AI startups could provide Intel with fresh insights and technological advancements.

2. Investment in AI R&D:

Prioritizing AI research and development, as well as enhancing AI chip capabilities, could help Intel regain competitive ground.

3. Geographic Diversity in Production:

Expanding manufacturing capabilities in strategic locations worldwide could mitigate regulatory pressures and logistics costs.

Real-World Use Cases and Recommendations

For Investors:

Diversifying portfolios to include AI-centric enterprises might offer quicker returns than relying solely on large-cap companies like Intel.

For Engineers and Innovators:

Consider focusing on AI and semiconductor developments as career opportunities burgeon in areas like AI chip design and machine learning algorithms.

Conclusion and Quick Tips

Intel stands at a crossroads where strategic reinvention and market adaptability are crucial. By focusing on AI and diversifying manufacturing investment locations, Intel can potentially navigate these current challenges effectively. The following quick tips may guide stakeholders:

– Invest in AI-Centric Companies: As the tech landscape shifts, adaptability to AI trends can secure market leadership.

– Watch Regulatory Developments: Stay informed about U.S. government policies as they may impact long-term investment strategies and tech innovations.

For the latest on Intel and other tech trends, visit Intel or explore emerging AI companies for potential investment opportunities.