- Rocket Lab is the second-largest rocket launcher in the U.S., challenging industry leader SpaceX with its upcoming “Neutron” rocket.

- The acquisition of Mynaric marks Rocket Lab’s strategic expansion into satellite communication, aiming for rapid data transmission advances.

- The company is currently operating with negative free cash flow, and analysts expect it to become cash-flow positive by 2026.

- Investors face a high price-to-free cash flow ratio, suggesting potential overvaluation, with stocks trading under $20 from a previous peak.

- A significant growth in free cash flow is anticipated, with projections of a tenfold increase by 2031, promising long-term growth potential.

- Investment in Rocket Lab requires patience and strategic timing, as its ambitious projects may yield substantial future rewards.

Imagine a roaring inferno of innovation propelling humanity into the cosmos, crafting satellites with precision, and charting the previously unfathomable paths of the stars. Rocket Lab, a dynamic force carving its niche in the burgeoning space industry, dazzles with both ambition and potential. However, for shareholders and potential investors, the question remains: is it more shooting star than sound investment?

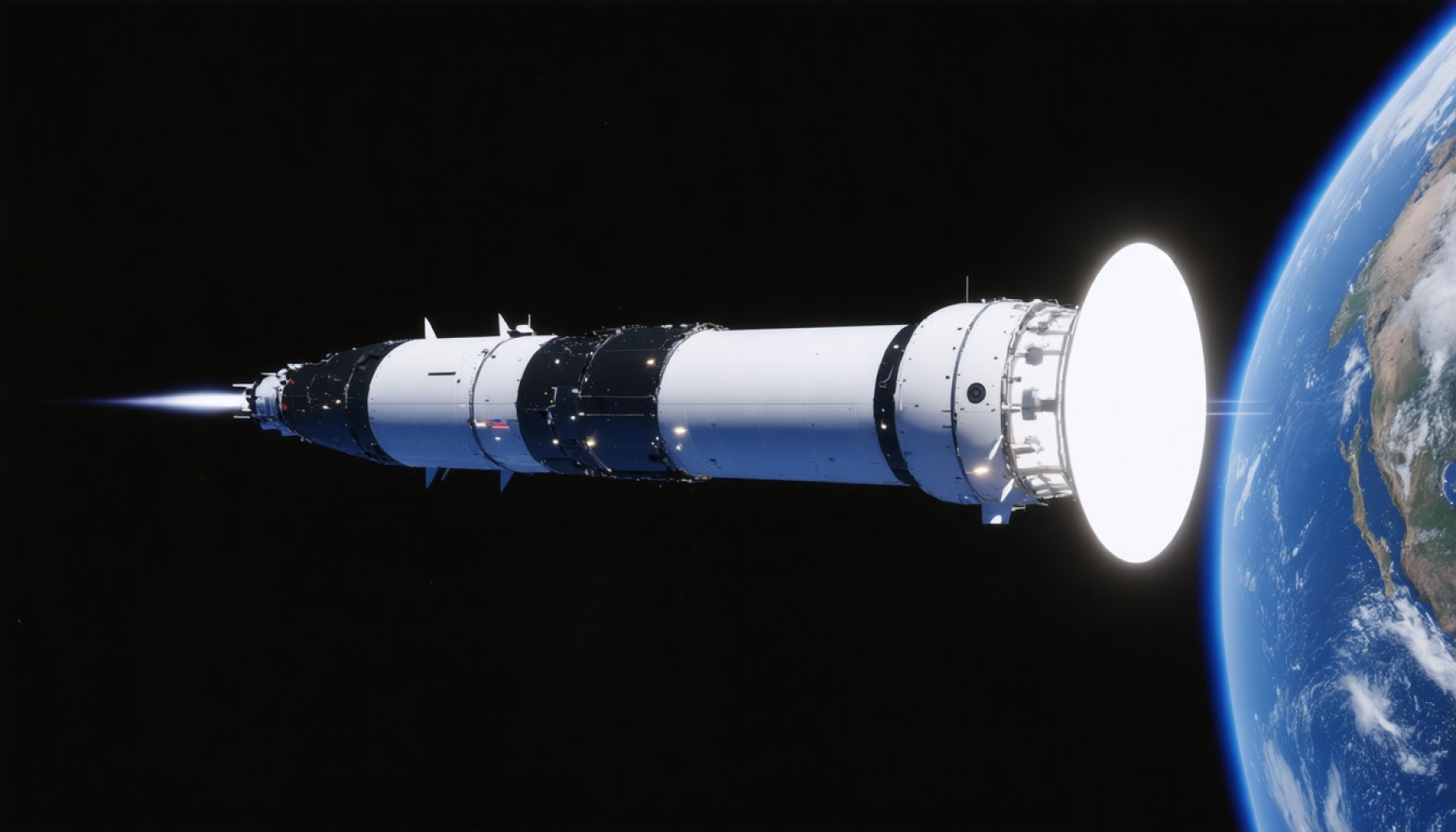

Rocket Lab stands as a beacon for those yearning to capitalize on the revolutionary tide of space exploration. Its meteoric rise to become the second-largest rocket launcher in the United States—trailing only behind SpaceX—cements its prowess. This isn’t just a tale of small rockets elegantly named “Electron”; Rocket Lab ambitiously enters the heavyweight division with its forthcoming “Neutron” rocket. A critical moment is anticipated this year as this larger orbital vehicle prepares for its inaugural flight, aiming to challenge SpaceX on a level battlefield.

Yet, the company is not solely stitching its legacy into rocketry. In a recent strategic maneuver, Rocket Lab acquired Mynaric, a German titan in laser communication technology. This acquisition signals a decisive push to enhance satellite communication capabilities, promising rapid data transmission across space. Such moves indicate Rocket Lab’s ambition to dominate not just in launching, but across the entire spectrum of space-based communication.

Despite these audacious endeavors, an unpunished truth lurks beneath the surface. As of recent reports, Rocket Lab operates in the red, with negative free cash flow. Market analysts, however, remain optimistic, projecting that the company could turn cash-flow positive by 2026. But as of now, investors wrestle with a price-to-free cash flow ratio of over 100, a daunting threshold suggesting potential overvaluation in its current state.

Now trading below $20, Rocket Lab’s price has dipped from its peak—a potential beacon for value seekers. The crux of the matter, however, reveals itself in the waiting game of growth versus valuation. Analysts predict an astounding growth in free cash flow, with projections suggesting a tenfold rise by 2031. Should this trajectory hold, Rocket Lab could soon find itself in a place where bold investments today translate to substantial rewards.

With its eyes firmly set on the stars, Rocket Lab’s journey from creating reliable small rockets to becoming an integral player in space logistics tells a compelling story. But for those clutching at its stock, the skies are still temperamental. The takeaway is clear: the promise is there, but patience and strategic entry points may be key for those who choose to hang their fortune on this rising star.

Rocket Lab: Destined for the Stars or a Risky Investment?

Rocket Lab’s Strategic Ventures and Industry Position

Rocket Lab has swiftly ascended to become the second-largest rocket launcher in the United States, closely following SpaceX. This remarkable growth reflects its capability and ambition in the private spaceflight sector. The company is not just focusing on launching rockets; it aims to diversify and expand its influence through strategic acquisitions, such as Mynaric. This move positions Rocket Lab at the forefront of advancing satellite communication technology with laser communications, potentially revolutionizing data transmission in space.

The Neutron Rocket: A Game-Changer?

Rocket Lab’s upcoming Neutron rocket marks its entry into the medium-to-heavy lift launch vehicle market, directly competing with SpaceX’s Falcon 9. This development is pivotal as it could significantly increase Rocket Lab’s market share in the commercial satellite launch sector. Key features of the Neutron include:

– Reusable Design: Like SpaceX, Rocket Lab aims for reusability, which could lower costs and improve profit margins.

– Increased Payload Capacity: Neutron is designed to carry larger payloads, catering to a different clientele and broadening its service range.

Financial Outlook and Investment Implications

Rocket Lab operates at a loss, with negative free cash flow a notable concern. However, analysts project that the company might turn cash flow positive by 2026. Currently, its price-to-free cash flow ratio exceeds 100, raising concerns about overvaluation. Nevertheless, its stock trading below $20 could attract value-oriented investors seeing potential in its long-term growth prospects. By 2031, Rocket Lab aims to increase its free cash flow tenfold, aligning with its expansion strategy in the space industry.

Market Forecast and Industry Trends

According to industry analysts, the global space economy could exceed $1 trillion by 2040, driven by satellite services, space tourism, and interplanetary exploration. Rocket Lab is well-positioned to capitalize on these trends:

– Satellite Services: Increased demand for satellite internet and Earth observation is expected to benefit companies like Rocket Lab.

– Space Logistics: As a burgeoning field, Rocket Lab’s initiatives in supply chain logistics for space missions could become a significant revenue stream.

Potential Risks and Challenges

– Technological Hurdles: Achieving reusability for Neutron is critical, and technological setbacks could delay profitability.

– Market Competition: SpaceX is a formidable competitor, and other entrants like Blue Origin could intensify market competition.

Actionable Recommendations for Investors

1. Monitor Technological Developments: Pay attention to Neutron’s development and testing phases for technological successes that could boost stock value.

2. Look for Strategic Partnerships: Collaborations with other tech companies in the space industry can signal growth potential.

3. Consider Long-term Potential: Invest with a long-term horizon if you believe in Rocket Lab’s vision and growth strategy.

Keywords

– Rocket Lab

– Neutron rocket

– Space industry

– Satellite communication

– Reusable launch vehicles

For detailed information on space exploration and technology, visit the Rocket Lab official website for updates directly from the company.