Pikosecond Laser Micromachining in 2025: Unleashing Ultra-Fast Precision for Next-Gen Manufacturing. Explore How This Disruptive Technology Is Shaping the Future of Microfabrication Across Industries.

- Executive Summary: Key Trends and Market Drivers

- Technology Overview: How Pikosecond Lasers Enable Ultra-Precise Micromachining

- Market Size and Forecast (2025–2029): Growth Trajectory and 18% CAGR Analysis

- Competitive Landscape: Leading Manufacturers and Innovators (e.g., coherent.com, trumpf.com, amc-laser.com)

- Application Spotlight: Electronics, Medical Devices, and Automotive Advancements

- Regional Analysis: North America, Europe, Asia-Pacific Market Dynamics

- Emerging Materials and Process Innovations

- Challenges: Technical Barriers, Cost Factors, and Adoption Hurdles

- Regulatory and Industry Standards (e.g., ieee.org, asme.org)

- Future Outlook: Disruptive Potential and Strategic Opportunities Through 2029

- Sources & References

Executive Summary: Key Trends and Market Drivers

Pikosecond laser micromachining is rapidly advancing as a critical technology for high-precision material processing across industries such as electronics, medical devices, automotive, and photonics. In 2025, the sector is characterized by a strong push towards higher throughput, finer feature resolution, and the ability to process a broader range of materials—including brittle, transparent, and composite substrates. The key trends and market drivers shaping the landscape are rooted in both technological innovation and evolving end-user demands.

A primary driver is the ongoing miniaturization of electronic components, particularly in the semiconductor and display industries. The demand for advanced packaging, flexible displays, and microelectromechanical systems (MEMS) is fueling the adoption of ultrafast lasers capable of sub-micron precision with minimal thermal damage. Leading manufacturers such as TRUMPF, Coherent, and Lumentum are investing in next-generation picosecond laser platforms that offer higher average powers, improved beam quality, and integrated automation for industrial-scale deployment.

Another significant trend is the expansion of picosecond laser micromachining into medical device manufacturing, where the need for burr-free, high-aspect-ratio features in polymers and metals is critical. Companies like Amada and IPG Photonics are developing systems tailored for stent cutting, catheter hole drilling, and microfluidic device fabrication, responding to stringent regulatory and quality requirements.

Sustainability and process efficiency are also shaping the market. Picosecond lasers enable “cold ablation,” reducing heat-affected zones and material waste, which aligns with the manufacturing sector’s push for greener, more resource-efficient processes. This is particularly relevant in the context of increasing environmental regulations and the need for cost-effective production.

Looking ahead to the next few years, the market is expected to see further integration of artificial intelligence and machine vision for real-time process monitoring and adaptive control, enhancing yield and reducing downtime. Additionally, the emergence of new laser sources—such as fiber-based and hybrid systems—will likely lower the cost of ownership and expand accessibility for small and medium-sized enterprises.

Overall, the outlook for picosecond laser micromachining in 2025 and beyond is robust, with continued innovation from established players like TRUMPF, Coherent, and Lumentum, as well as growing adoption across diverse high-value manufacturing sectors.

Technology Overview: How Pikosecond Lasers Enable Ultra-Precise Micromachining

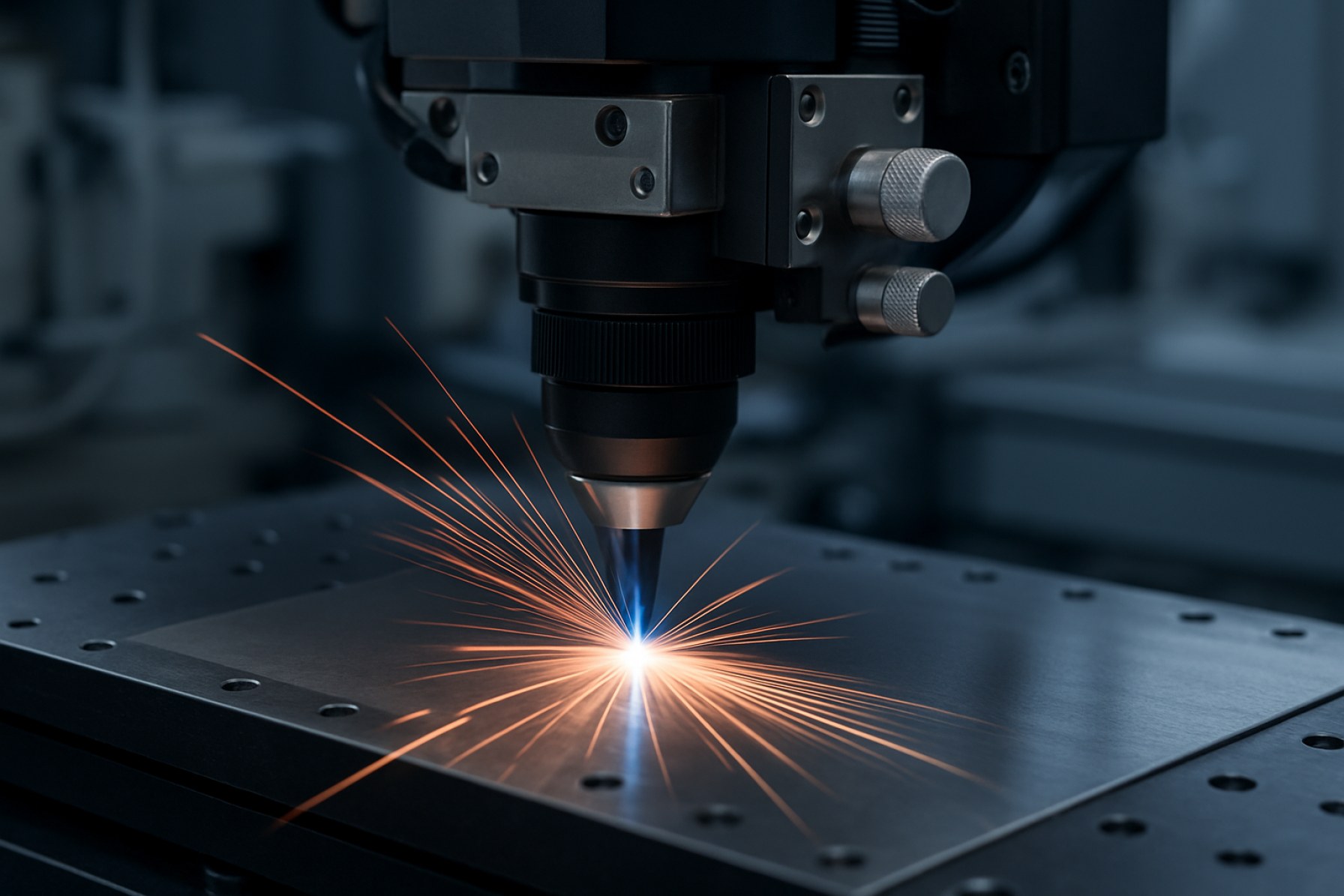

Pikosecond laser micromachining represents a transformative advance in precision material processing, leveraging laser pulses with durations in the range of 1–100 picoseconds. This ultra-short pulse duration enables “cold ablation,” where material is removed with minimal thermal diffusion, resulting in sharply defined features and negligible heat-affected zones. As of 2025, this technology is increasingly adopted for applications demanding sub-micron accuracy, such as semiconductor manufacturing, medical device fabrication, and microelectronics.

The core advantage of pikosecond lasers lies in their ability to deliver high peak powers in extremely short bursts, which vaporize material before significant heat can spread to the surrounding substrate. This contrasts with longer-pulse or continuous-wave lasers, which often cause melting, recast layers, or microcracks. The result is a dramatic improvement in edge quality, feature resolution, and process repeatability. For example, in the production of microfluidic devices and stents, the technology enables the creation of intricate geometries in polymers and metals without post-processing.

Key industry players are driving innovation in this field. TRUMPF, a global leader in industrial lasers, offers a range of ultrashort pulse lasers specifically designed for micromachining, emphasizing reliability and integration into automated production lines. Coherent is another major manufacturer, providing high-repetition-rate pikosecond lasers tailored for high-throughput applications in display and electronics manufacturing. Lumentum and Amplitude Laser are also recognized for their advanced ultrafast laser platforms, supporting both research and industrial-scale deployment.

Recent developments focus on increasing average power and pulse energy while maintaining beam quality and stability. This enables faster processing speeds and the ability to machine harder or more reflective materials, such as sapphire and ceramics, which are critical in sectors like consumer electronics and photonics. Additionally, advances in beam delivery systems, such as high-precision galvo scanners and multi-axis stages, are expanding the range of achievable geometries and surface finishes.

Looking ahead to the next few years, the outlook for pikosecond laser micromachining is robust. Ongoing improvements in laser source efficiency, system integration, and process automation are expected to further reduce costs and expand accessibility. As device miniaturization and material complexity continue to increase across industries, demand for ultra-precise, low-damage micromachining solutions is set to grow, solidifying the role of pikosecond lasers as a cornerstone technology in advanced manufacturing.

Market Size and Forecast (2025–2029): Growth Trajectory and 18% CAGR Analysis

The global market for pikosecond laser micromachining is poised for robust expansion between 2025 and 2029, with industry consensus pointing to a compound annual growth rate (CAGR) of approximately 18%. This growth trajectory is underpinned by escalating demand for high-precision manufacturing in sectors such as microelectronics, medical device fabrication, and advanced materials processing. Pikosecond lasers, characterized by their ultra-short pulse durations, enable minimal heat-affected zones and superior edge quality, making them indispensable for next-generation micromachining applications.

Key industry players are scaling up production capacities and investing in R&D to address the evolving requirements of end-users. TRUMPF, a global leader in industrial laser technology, continues to expand its portfolio of ultrafast lasers, including systems tailored for high-throughput, high-precision micromachining. Similarly, Coherent is advancing its range of picosecond laser platforms, targeting applications in semiconductor wafer dicing, OLED display patterning, and medical stent manufacturing. Amplitude Laser and Lumentum are also notable for their innovations in high-power, high-repetition-rate picosecond sources, which are increasingly adopted in both research and industrial settings.

The Asia-Pacific region, led by China, Japan, and South Korea, is expected to account for the largest share of market growth, driven by the rapid expansion of electronics manufacturing and government initiatives supporting advanced manufacturing technologies. European and North American markets are also witnessing increased adoption, particularly in medical device and automotive component fabrication, where precision and material integrity are paramount.

Recent data from leading manufacturers indicate a surge in orders for integrated micromachining workstations, reflecting a shift toward turnkey solutions that combine laser sources, beam delivery, and process automation. For instance, TRUMPF and Coherent have both reported double-digit growth in their ultrafast laser divisions over the past year, with expectations of continued momentum through 2029.

Looking ahead, the market outlook remains highly favorable, with ongoing advancements in laser source efficiency, pulse control, and system integration expected to further broaden the application landscape. As manufacturers seek to miniaturize components and improve throughput without compromising quality, the adoption of pikosecond laser micromachining is set to accelerate, reinforcing its position as a cornerstone technology in precision manufacturing.

Competitive Landscape: Leading Manufacturers and Innovators (e.g., coherent.com, trumpf.com, amc-laser.com)

The competitive landscape for picosecond laser micromachining in 2025 is characterized by a dynamic interplay between established global leaders and agile innovators, each driving advancements in precision, throughput, and application diversity. The sector is witnessing intensified R&D efforts, with manufacturers focusing on higher pulse energies, improved beam quality, and integration with automation and digital manufacturing platforms.

Among the most prominent players, Coherent Corp. continues to set benchmarks in ultrafast laser technology. The company’s picosecond laser systems are widely adopted in electronics, medical device manufacturing, and microelectronics, offering high stability and reliability for industrial-scale micromachining. Coherent’s recent product lines emphasize modularity and ease of integration, catering to the growing demand for flexible manufacturing solutions.

Another industry heavyweight, TRUMPF Group, leverages its extensive expertise in industrial lasers to deliver picosecond systems tailored for high-precision applications such as semiconductor processing, display fabrication, and fine metal structuring. TRUMPF’s focus on digital connectivity and process monitoring aligns with the broader Industry 4.0 movement, enabling real-time quality control and predictive maintenance in micromachining environments.

Specialized manufacturers like Advanced Microoptic Systems GmbH (AMC Laser) are gaining traction by offering customizable picosecond laser platforms. AMC Laser is recognized for its compact, air-cooled designs and user-friendly interfaces, making advanced micromachining accessible to research institutions and small-to-medium enterprises. Their systems are particularly noted for applications in microfluidics, photonics, and biomedical device prototyping.

Other notable contributors include Lumentum Holdings Inc., which supplies ultrafast lasers for both industrial and scientific markets, and Spectra-Physics (a division of MKS Instruments), known for its high-repetition-rate picosecond lasers used in precision micromachining and advanced materials processing. These companies are investing in higher average power and shorter pulse durations to address emerging needs in 3D microfabrication and transparent material processing.

Looking ahead, the competitive landscape is expected to evolve rapidly as manufacturers respond to increasing demand for miniaturized components in electronics, medical devices, and photonics. Strategic collaborations between laser suppliers, automation integrators, and end-users are anticipated to accelerate innovation cycles. The integration of AI-driven process optimization and real-time monitoring is likely to become a key differentiator, with leading companies positioning themselves at the forefront of smart manufacturing in picosecond laser micromachining.

Application Spotlight: Electronics, Medical Devices, and Automotive Advancements

Pikosecond laser micromachining is rapidly advancing as a key enabling technology across electronics, medical devices, and automotive manufacturing. In 2025, the demand for ultra-precise, high-throughput micromachining is being driven by the miniaturization of components, the need for higher reliability, and the integration of novel materials.

In the electronics sector, pikosecond lasers are increasingly used for drilling microvias in printed circuit boards (PCBs), patterning flexible substrates, and processing advanced semiconductor materials. The ability of these lasers to ablate material with minimal heat-affected zones is critical for next-generation devices. Leading equipment manufacturers such as TRUMPF and Coherent have introduced systems capable of high-speed, high-precision processing of brittle and composite materials, supporting the production of 5G components and advanced packaging. Amplitude and Lumentum are also notable for their ultrafast laser solutions tailored to microelectronics, with ongoing R&D focused on improving throughput and process flexibility.

In medical device manufacturing, the trend toward minimally invasive devices and microfluidic systems is accelerating the adoption of pikosecond laser micromachining. The technology enables the fabrication of intricate features in polymers, metals, and bioresorbable materials without introducing thermal damage or contamination. Companies like TRUMPF and Coherent are supplying laser platforms for stent cutting, catheter hole drilling, and surface texturing, supporting both prototyping and high-volume production. The precision and cleanliness of the process are particularly valued for implantable devices, where biocompatibility and structural integrity are paramount.

The automotive industry is leveraging pikosecond lasers for applications such as airbag initiator drilling, fuel injector nozzle fabrication, and the structuring of battery components for electric vehicles. As automotive electronics become more sophisticated and lightweighting initiatives intensify, the need for precise, non-contact machining grows. TRUMPF and Amplitude are among the suppliers providing solutions for high-speed, automated production lines, with a focus on process reliability and scalability.

Looking ahead, the outlook for pikosecond laser micromachining is robust. Ongoing improvements in laser source efficiency, beam delivery, and process automation are expected to further expand its adoption. Industry leaders are investing in AI-driven process monitoring and closed-loop control to enhance yield and reduce downtime. As device architectures continue to shrink and material complexity increases, the role of ultrafast laser micromachining in enabling next-generation products across electronics, medical, and automotive sectors is set to grow significantly through 2025 and beyond.

Regional Analysis: North America, Europe, Asia-Pacific Market Dynamics

The global market for pikosecond laser micromachining is experiencing dynamic growth, with North America, Europe, and Asia-Pacific each exhibiting distinct trends and drivers as of 2025 and looking ahead. These regions are shaped by their respective industrial bases, R&D investments, and adoption rates in sectors such as electronics, medical devices, and precision engineering.

North America remains a leader in technological innovation and early adoption of advanced laser micromachining. The United States, in particular, benefits from a robust semiconductor and medical device manufacturing sector, with companies like Coherent and IPG Photonics at the forefront of developing and supplying high-performance ultrafast laser systems. These firms are investing in expanding their product portfolios to address the growing demand for high-precision, low-thermal-impact micromachining in applications such as microelectronics and bioengineering. The region’s strong university-industry collaborations and government funding for advanced manufacturing are expected to sustain growth through 2025 and beyond.

Europe is characterized by a strong emphasis on precision engineering, automotive innovation, and medical technology. Countries like Germany, Switzerland, and France are home to leading laser manufacturers such as TRUMPF and Lumentum, which are actively advancing ultrafast laser technologies for micromachining. The European Union’s focus on digitalization and Industry 4.0 initiatives is accelerating the integration of pikosecond lasers into automated manufacturing lines. Additionally, the region’s stringent quality standards in sectors like aerospace and medical devices are driving demand for the superior edge quality and minimal heat-affected zones offered by pikosecond laser processing. Ongoing investments in R&D and cross-border collaborations are expected to further strengthen Europe’s position in the coming years.

Asia-Pacific is emerging as the fastest-growing market, propelled by the rapid expansion of electronics manufacturing, especially in China, Japan, South Korea, and Taiwan. Major regional players such as Advanced Micro-Fabrication Equipment Inc. (AMEC) and Hamamatsu Photonics are scaling up production and innovation in ultrafast laser systems to meet the surging demand for miniaturized components and high-throughput processing. The region’s governments are supporting advanced manufacturing through policy incentives and infrastructure investments, further accelerating adoption. As Asia-Pacific continues to dominate global electronics and display manufacturing, the outlook for pikosecond laser micromachining remains highly positive, with double-digit growth anticipated in the next few years.

Overall, while North America and Europe focus on high-value, precision-driven applications, Asia-Pacific’s scale and manufacturing intensity are set to make it the largest market for pikosecond laser micromachining by the late 2020s.

Emerging Materials and Process Innovations

Pikosecond laser micromachining is rapidly advancing as a key enabling technology for precision manufacturing, particularly in sectors demanding minimal thermal damage and high aspect ratio features. As of 2025, the field is witnessing significant innovations in both the materials being processed and the underlying laser systems, driven by the need for higher throughput, finer resolution, and compatibility with next-generation materials.

A major trend is the expansion of processable materials beyond traditional metals and semiconductors to include advanced ceramics, transparent polymers, and composite substrates. For example, the ability of ultrashort pulse lasers to ablate materials with minimal heat-affected zones has enabled the precise structuring of brittle materials like sapphire and glass, which are increasingly used in electronics and photonics. Companies such as TRUMPF and Coherent are at the forefront, offering industrial-grade picosecond laser systems tailored for these challenging materials, with applications ranging from smartphone cover glass to microfluidic devices.

Recent years have also seen the integration of beam shaping and multi-beam technologies, allowing for parallel processing and increased throughput. Lumentum and Amplitude are notable for their development of high-power, high-repetition-rate picosecond lasers, which are being adopted in both R&D and volume manufacturing environments. These systems are increasingly equipped with real-time process monitoring and adaptive control, enabling closed-loop feedback for consistent quality even with complex geometries or heterogeneous materials.

On the materials side, the emergence of novel substrates—such as flexible electronics, bioresorbable polymers for medical devices, and advanced battery materials—has spurred collaborative development between laser manufacturers and material suppliers. For instance, TRUMPF has partnered with electronics and medical device companies to optimize laser parameters for new polymers and composites, ensuring precise feature definition without compromising material integrity.

Looking ahead to the next few years, the outlook for picosecond laser micromachining is robust. The ongoing miniaturization in microelectronics, the proliferation of wearable and implantable devices, and the demand for high-density interconnects are expected to drive further adoption. Industry leaders are investing in AI-driven process optimization and hybrid manufacturing platforms that combine laser micromachining with additive or subtractive techniques, aiming to unlock new design freedoms and cost efficiencies. As these innovations mature, picosecond laser micromachining is poised to become a cornerstone technology for advanced manufacturing across multiple high-value sectors.

Challenges: Technical Barriers, Cost Factors, and Adoption Hurdles

Pikosecond laser micromachining has emerged as a transformative technology for precision manufacturing, yet its broader adoption in 2025 and the coming years faces several significant challenges. These hurdles span technical limitations, cost considerations, and market adoption dynamics, all of which shape the pace and scope of industry integration.

One of the primary technical barriers is the complexity of generating and controlling ultrashort laser pulses at high repetition rates with consistent beam quality. Achieving stable operation in the picosecond regime requires advanced laser architectures and precise thermal management. Leading manufacturers such as TRUMPF and Coherent have made substantial progress in developing robust, industrial-grade picosecond laser systems, but maintaining reliability and minimizing downtime in demanding production environments remains a challenge. Additionally, the interaction of picosecond pulses with diverse materials can lead to unpredictable ablation thresholds and debris formation, necessitating ongoing research into process optimization and real-time monitoring solutions.

Cost factors also present a significant hurdle. The initial capital investment for picosecond laser systems is considerably higher than for nanosecond or femtosecond alternatives, due to the sophisticated components and precision engineering required. For example, systems from Amplitude Laser and Lumentum are positioned at the premium end of the market, reflecting their advanced capabilities but also limiting accessibility for small and medium-sized enterprises. Furthermore, operational costs—including maintenance, consumables, and the need for skilled technicians—add to the total cost of ownership, potentially slowing adoption in cost-sensitive sectors.

Adoption hurdles are further compounded by the need for specialized expertise in both system operation and process integration. Many end-users require tailored solutions to address specific application requirements, such as microelectronics, medical device fabrication, or precision optics. This often involves close collaboration with equipment suppliers like TRUMPF and Coherent, as well as investment in workforce training and process development. The lack of standardized protocols and limited interoperability with existing manufacturing lines can also impede seamless integration.

Looking ahead, industry stakeholders are actively working to address these challenges. Efforts include the development of more compact, user-friendly systems, advances in automation and process monitoring, and initiatives to reduce system costs through economies of scale and component innovation. As these solutions mature, the outlook for broader adoption of picosecond laser micromachining is expected to improve, particularly in high-value manufacturing sectors where precision and minimal thermal damage are paramount.

Regulatory and Industry Standards (e.g., ieee.org, asme.org)

Pikosecond laser micromachining, a precision technique for material processing at the micro- and nano-scale, is increasingly governed by evolving regulatory and industry standards as its adoption accelerates across sectors such as electronics, medical devices, and aerospace. In 2025 and the coming years, the regulatory landscape is shaped by both international and regional bodies, with a focus on safety, process repeatability, and quality assurance.

The IEEE continues to play a pivotal role in standardizing laser safety and performance, particularly through its ongoing updates to the IEEE C95 series, which addresses electromagnetic exposure and laser safety in industrial environments. These standards are critical for manufacturers and end-users to ensure compliance with occupational health and safety requirements, especially as laser systems become more powerful and widely deployed.

Similarly, the ASME is actively involved in developing and updating standards related to laser-based manufacturing processes. ASME’s Y14 series, which covers engineering drawing and documentation practices, is increasingly referenced for the precise tolerances and feature definitions required in micromachining applications. This ensures that components produced via pikosecond laser systems meet stringent dimensional and quality criteria, which is particularly important in regulated industries such as medical device manufacturing.

On the international front, the International Organization for Standardization (ISO) maintains and updates standards such as ISO 11553, which addresses the safety of machinery using laser processing. The ISO 11145 and ISO 11146 standards, which define laser and beam parameters, are also being revised to accommodate the unique characteristics of ultrafast lasers, including those operating in the picosecond regime. These updates are expected to be finalized or further advanced by 2025, reflecting the rapid technological progress in the field.

Industry consortia and working groups, such as those coordinated by the Laser Institute of America (LIA), are also instrumental in shaping best practices and providing training for safe and effective use of pikosecond laser systems. LIA’s ANSI Z136 series remains the benchmark for laser safety in North America, with ongoing revisions to address new applications and higher power levels.

Looking ahead, the next few years will likely see increased harmonization of standards across regions, driven by the globalization of supply chains and the need for interoperability. Regulatory bodies are expected to place greater emphasis on traceability, process validation, and environmental considerations, particularly as micromachining is adopted for advanced applications such as semiconductor packaging and bioresorbable medical implants. As a result, manufacturers and users of pikosecond laser systems will need to stay abreast of evolving standards to maintain compliance and competitive advantage.

Future Outlook: Disruptive Potential and Strategic Opportunities Through 2029

Pikosecond laser micromachining is poised for significant evolution through 2029, driven by advances in ultrafast laser technology, increasing demand for precision manufacturing, and the expansion of applications in electronics, medical devices, and photonics. The unique ability of picosecond lasers to deliver high peak power pulses with minimal thermal effects enables the processing of delicate and complex materials, positioning this technology as a disruptive force in next-generation manufacturing.

Key industry players such as TRUMPF, Coherent, and Lumentum are investing heavily in the development of more compact, energy-efficient, and higher repetition rate picosecond laser systems. These companies are focusing on improving beam quality, pulse control, and system integration to address the stringent requirements of microelectronics and medical device fabrication. For example, TRUMPF has introduced new picosecond laser platforms designed for high-throughput, high-precision micromachining of brittle materials such as glass and ceramics, which are increasingly used in advanced displays and semiconductor packaging.

The electronics sector, particularly in Asia, is expected to be a major driver of growth. The ongoing miniaturization of components and the shift toward heterogeneous integration in semiconductor manufacturing are creating new opportunities for picosecond laser processing. Companies like Han’s Laser are expanding their product portfolios to cater to the needs of flexible printed circuit board (FPCB) cutting, via drilling, and OLED display patterning, all of which benefit from the non-thermal, high-precision ablation offered by picosecond lasers.

In the medical device industry, the demand for minimally invasive tools and bio-compatible implants is accelerating the adoption of picosecond laser micromachining. Amada and IPG Photonics are developing systems tailored for stent cutting, microfluidic device fabrication, and surface texturing of implants, leveraging the technology’s ability to create intricate features without compromising material integrity.

Looking ahead to 2029, the integration of artificial intelligence and machine vision with picosecond laser systems is anticipated to further enhance process automation, quality control, and adaptive manufacturing. Strategic partnerships between laser manufacturers, automation specialists, and end-users are likely to accelerate the deployment of smart micromachining solutions across industries. As sustainability becomes a priority, the low-waste, energy-efficient nature of picosecond laser processing will also align with global environmental goals, reinforcing its disruptive potential in advanced manufacturing.

Sources & References

- TRUMPF

- Coherent

- Lumentum

- Amada

- IPG Photonics

- Amplitude Laser

- Hamamatsu Photonics

- IEEE

- ASME

- International Organization for Standardization (ISO)

- Han’s Laser